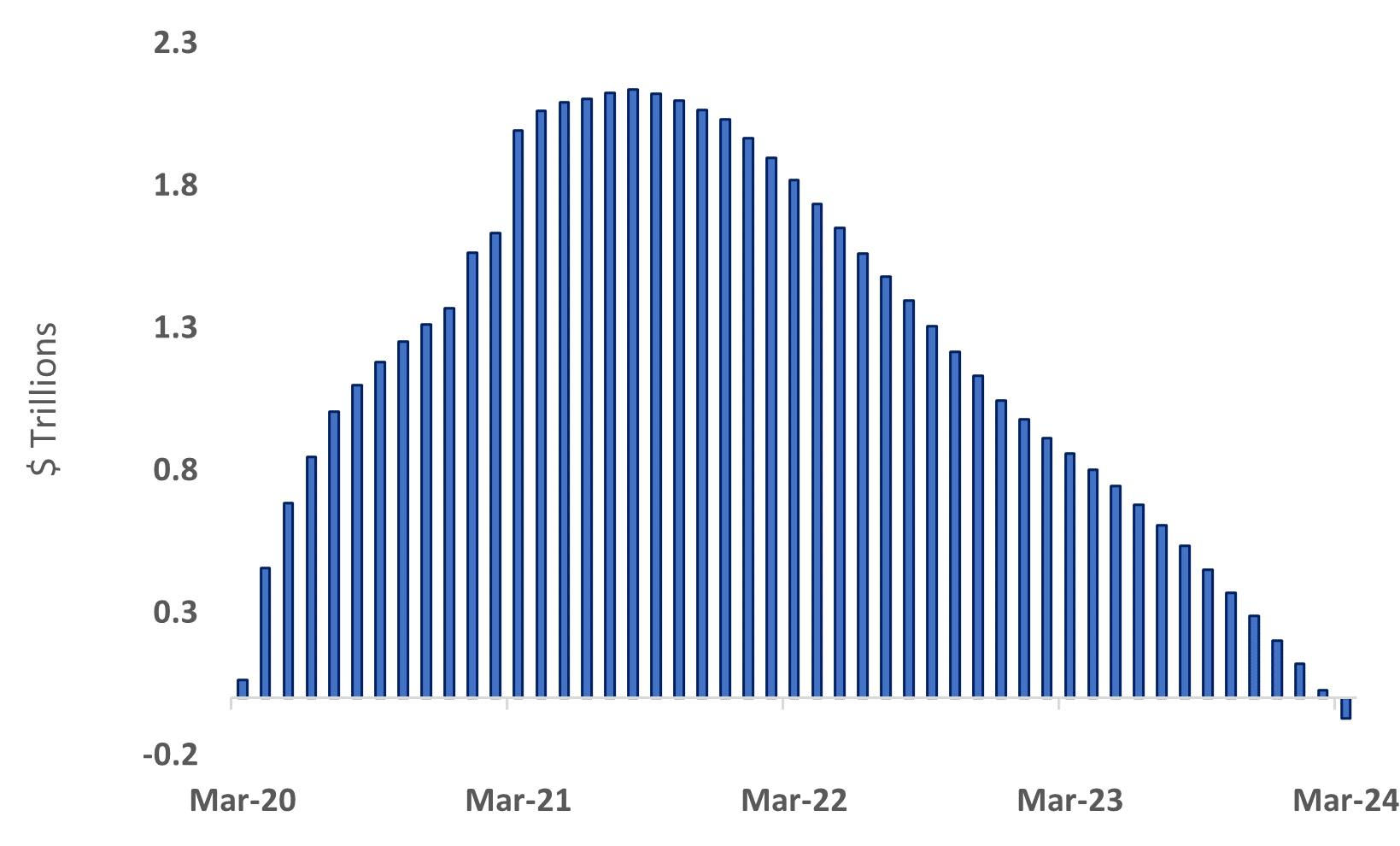

“Excess Savings” has been a hot topic since the pandemic, and it behooves investors to understand this as we go through the latter part of this business cycle. The San Francisco Federal Reserve (Fed) defines excess savings as the dollar amount of savings over and above the pre-COVID-19 trend. Excess savings peaked at $2.1 trillion in August 2021, when many households received support via pandemic-related stimulus. Weak spending, especially on services, also contributed to the rise in excess savings.

But as households made up for lost time and splurged on both goods and services, excess savings were drawn down.

Source: LPL Research, San Francisco Federal Reserve, Bureau of Economic Analysis 05/08/24

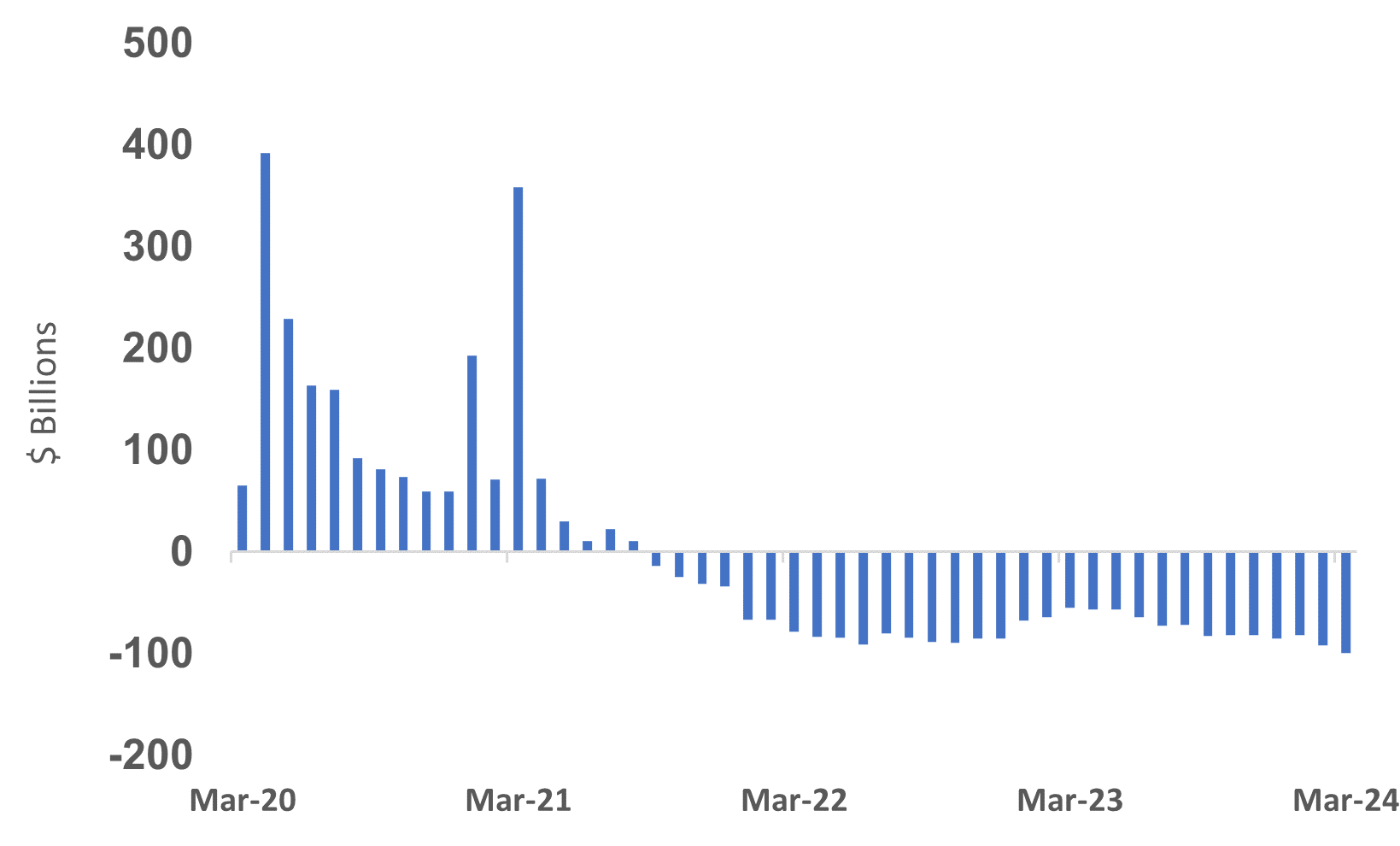

It’s no surprise that consumers have been drawing down excess savings for quite a while now. In fact, excess savings have been shrinking since the summer of 2021 as spending grew faster than real disposable incomes.

Source: LPL Research, San Francisco Federal Reserve, Bureau of Economic Analysis 05/08/24

As excess savings dwindle, there are potential risks to consumer spending. When households exhaust these accumulated savings, it could lead to a decline in discretionary spending. Additionally, if the depletion of excess savings is not met with a corresponding increase in income or economic growth, it could potentially dampen the pace of economic growth.

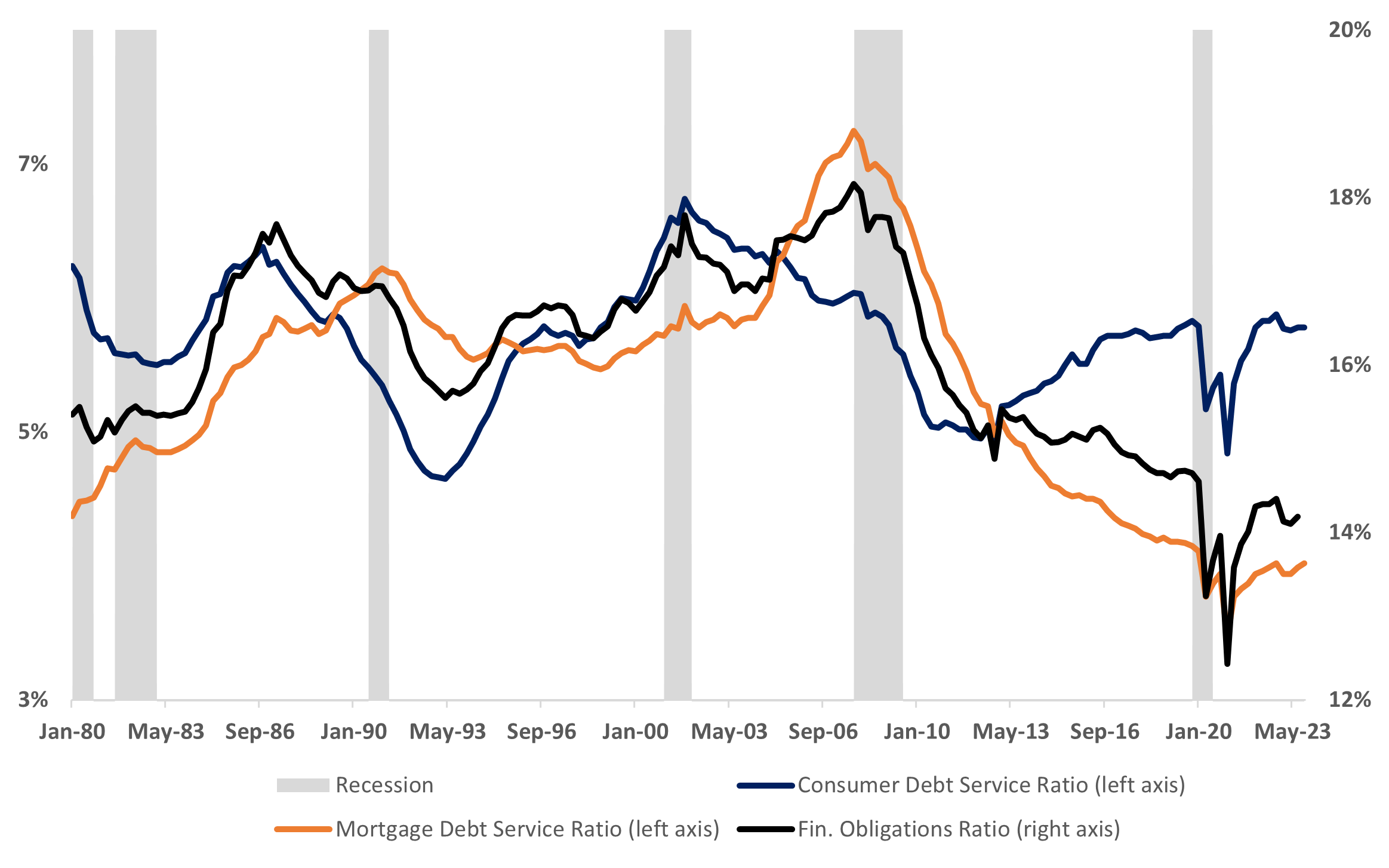

However, healthy household balance sheets supported by low mortgage debt servicing costs will soften the blow from a smaller stock of savings. The large number of households who refinanced mortgages after the pandemic but before the Fed started raising rates now have an historically low level of mortgage debt service. The extra money saved from lower mortgage costs will likely offset the decline in excess savings.

Source: LPL Research, Federal Reserve Board 05/08/24

Consumer spending is a sizable part of the economic engine, and as we saw from recent earnings reports from companies such as Amazon (AMZN) and Apple (AAPL), the consumer has been supporting economic growth. However, is the spending splurge over?

A key takeaway is upper-income households still have some tailwinds — one is historically low mortgage debt service. Given the decline in excess savings, investors will consider labor market trends even more closely for any leading indicators of future consumer spending.

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral equity stance tactically. The improved economic and earnings outlook this year has kept the risk-reward trade-off for stocks and bonds well balanced, perhaps with a slight edge to bonds over stocks currently when looking out to year end. Recent stubbornly high inflation readings likely delayed Fed rate cuts and may limit the upside to stock prices over the balance of the year, although two cuts may still come by year end.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: #576319

Jeffrey Roach guides the overall view of the economy for LPL Financial Research and has over 20 years of experience in investing and economics.